About Course

A comprehensive Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Training Programme tailored for St. Vincent and the Grenadines. The programme includes assessment questions for all company employees including Board and Committee members. The questions are designed to test knowledge, understanding, and practical application of AML/CFT laws and regulations in St. Vincent and the Grenadines.

Course Content

Module 1: AML/CFT Laws and Regulations in St. Vincent and the Grenadines

-

Summary

-

AML and CFT Laws and Regulations in SVG – PDF

-

Module 1 Quiz

Module 2: Role of the Designated Money Laundering Reporting Officer (MLRO)

Module 3: Roles and Responsibilities of Staff

Module 4: Elements of a Successful AML/CFT Programme

Module 5: Internal Policies, Procedures, and Controls

Module 6: Strengthening KYC and Risk Based Approaches

Module 7: Identifying Red Flags and Suspicious Activities

Module 8: Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

Module 9: Transaction Monitoring and Reporting

Module 10: Customer Risk Rating and Sanctions Screening

Module 11: Employee Training Program

Module 12: Document Retention

Module 13: Politically Exposed Persons

Module 14: Reporting Obligations Under POCA

Module 15: Transaction Monitoring

Module 16: Record-Keeping

Module 17: Independent Testing

Module 18: Know Your Employees (KYE)

Module 19: Surveillance and Case Management

Module 20: Compliance Culture and Awareness

Course Completion Assessment

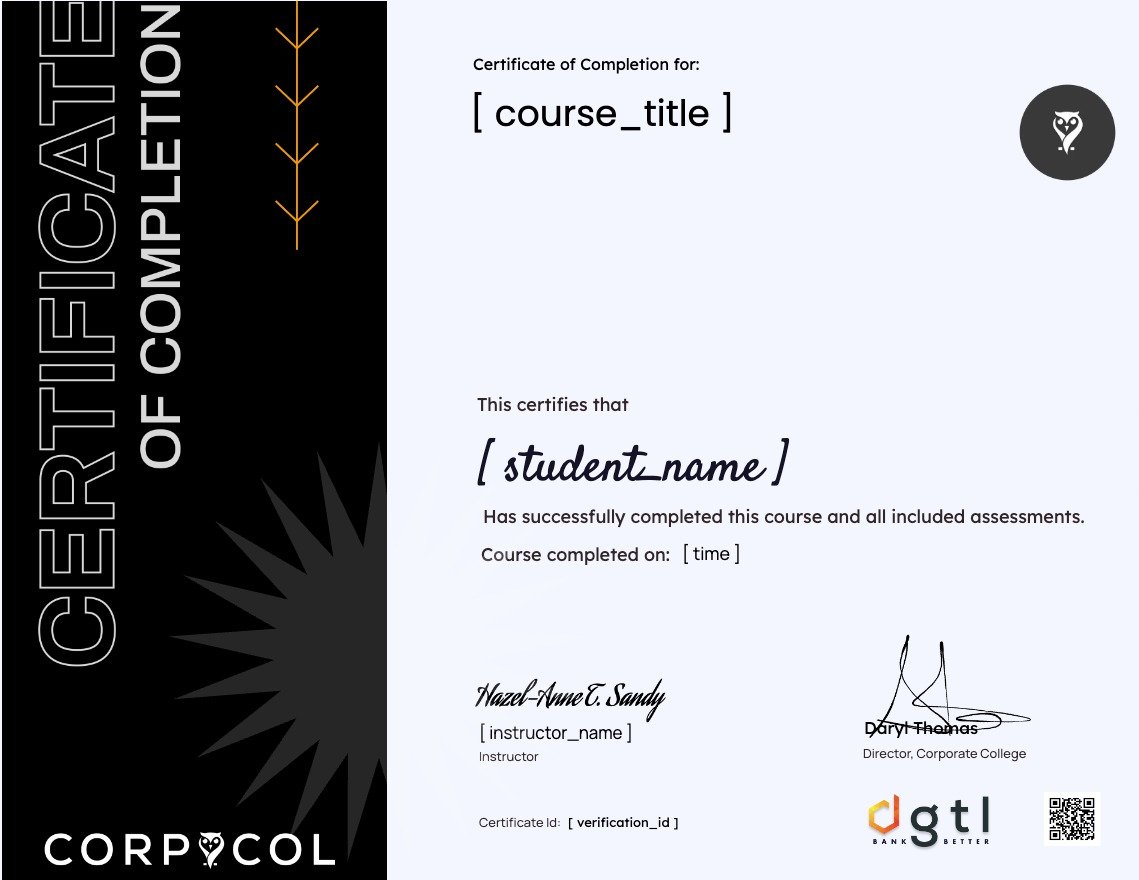

Earn a certificate of Completion

Add this certificate to your resume to demonstrate your skills & knowledge.

Student Ratings & Reviews

No Review Yet